Payments Solutions for Small Businesses

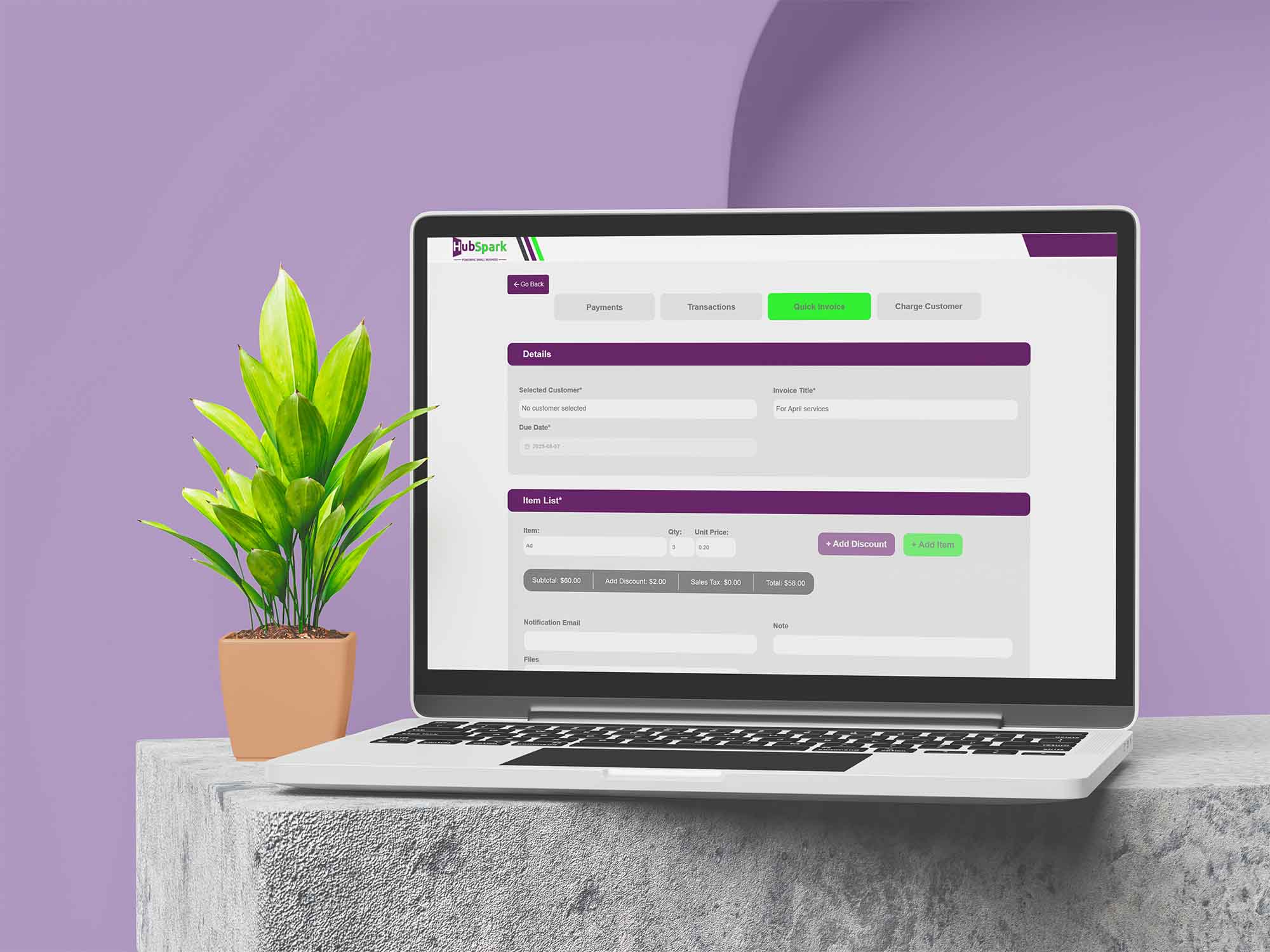

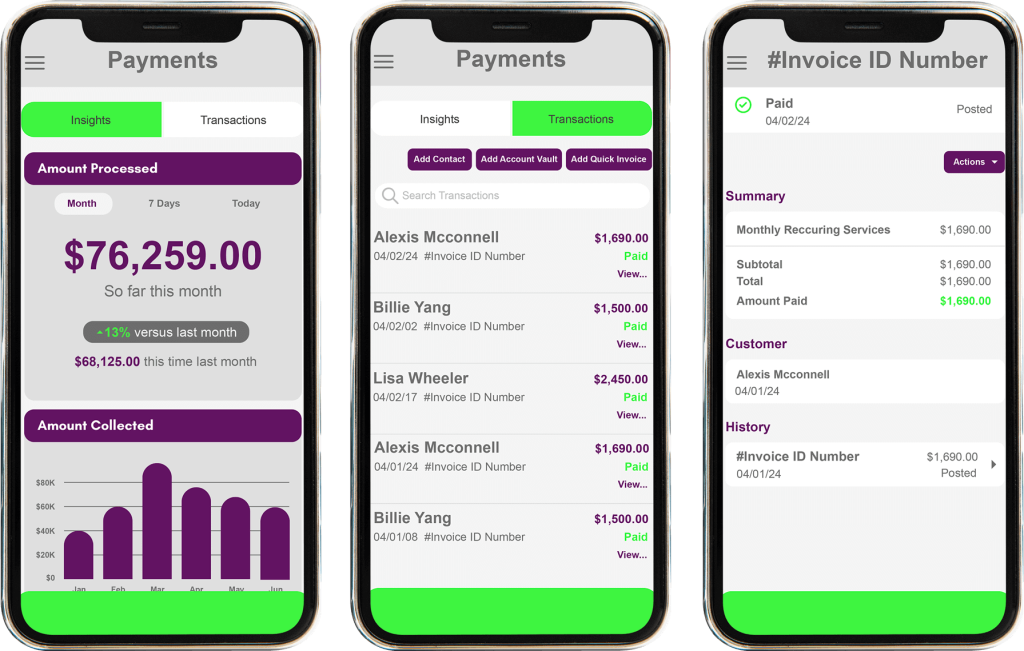

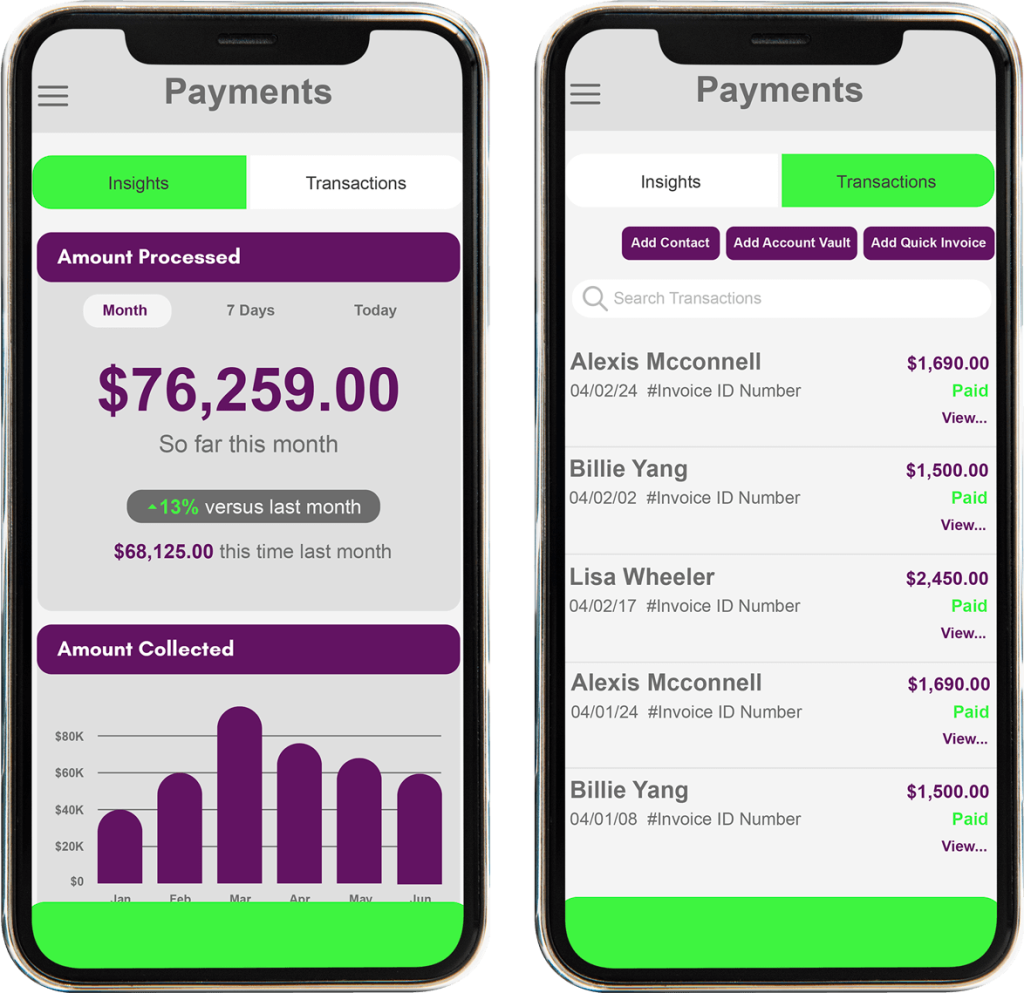

HubSpark Payments: Streamlining Transactions and Enhancing Customer Experience

Comprehensive Payment Options

HubSpark Payments offers a suite of features to help small businesses boost customer engagement, gather reviews, and streamline payment processes. Offering a variety of payment methods, including financing and subscriptions, ensures easy and convenient transactions for businesses and customers.

Seamless Communication and Transactions

Handle payment transactions within the same text communication channel you use for customer interactions. This approach ensures timely payments, saves time for both parties and provides a secure environment with advanced fraud protection and automatic reconciliation.

Mobile-Friendly and Cardless Transactions

Transform your phone into a secure card reader, eliminating the need for additional hardware. HubSpark Payments allows businesses to offer a seamless payment experience, from sending estimates to receiving payments, all in one centralized platform.

Retail Payment Systems: A Vital Component for Customer Satisfaction

To ensure business success, it’s crucial to implement the right retail payment system. This not only facilitates revenue collection but also enhances the overall customer experience, especially in a rapidly evolving digital landscape.

Understanding Retail Payment Systems

A retail payment system manages transactions between a company and its buyers, allowing funds transfer for goods and services. Retail payment systems cater to both businesses and consumers, with higher transaction volumes and generally lower individual transaction values.

Common Types of Retail Payment Systems

Cash Payments

- Suitable for low-value transactions

- Not applicable for online retailers

- Declining usage among consumers

ACH Payments

- Replacing paper-based methods

- Ideal for large-value and recurring transactions

- Secure digital option for various payments

Card Payments

- Widely accepted, especially credit and debit cards

- Efficient for both online and in-store transactions

- Growing popularity due to ease of use

Mobile Payments

- Increasing in use in our digital age

- Enables various payment methods, including mobile wallets

- SMS-based services, like HubSpark Payments, gaining traction

Advantages of a Well-Chosen Retail Payment System

Selecting the right retail payment system positively impacts customer payments, business earnings, and fund reception speed. It ensures a convenient user experience, encourages timely payments, and contributes to overall business efficiency.

Utilizing Retail Payment Solutions

Unless opting for a cash-only strategy or developing a proprietary system, integrating an online payment service is beneficial. Third-party solutions, like HubSpark Payments, offer several advantages for businesses:

Time-Saving or Time-Saver

Automation streamlines processes, reducing manual effort.

Transaction Oversight

Online services track and make transactions searchable for efficient customer service.

Security

Enhanced security features protect against fraud, chargebacks, and unauthorized transactions.

Competitive Edge

Staying ahead by adopting modern payment systems used by competitors.

Enhance Shopping Experience with HubSpark Payments

HubSpark Payments is a versatile retail payment solution offering a standout customer experience. Utilizing text message payments, encourages prompt checkouts via SMS, improving customer satisfaction without imposing monthly fees. Businesses can integrate HubSpark Payments seamlessly into their strategies for efficient transactions.

Effortless Payments with HubSpark

Complete Payment Solution

HubSpark offers a comprehensive payment experience across text, scan, card readers, websites, and more. Effortless payments begin with HubSpark's transparent, secure, and complete payment solution.

Digital Payments

HubSpark facilitates digital payment options, including credit, debit, and mobile payments. With text-based transactions and scannable QR codes, HubSpark ensures a convenient and mobile-friendly payment experience.

Card Readers

Master the point of sale with HubSpark's card reader solutions, offering contactless, EMV, and swiped card payments. Whether at the counter or on-site, HubSpark provides flexibility and convenience.

Automated Payments

HubSpark streamlines collections with automated options for buy now, pay later, recurring payments, and flexible financing. Automate your payment processes, offer partial payment options, and get paid ahead of time.

Payment Processing

HubSpark Payment ensures fast processing, secure, and transparent transactions. Track transactions, eliminate surprise charges, and minimize fraud risk with world-class infrastructure and PCI compliance.

Payment Integrations

Integrate seamlessly with leading accounting, CRM, and PMS systems. Automatically send payment requests, follow up on past-due balances, and close invoices with HubSpark Payments integrations.

ACH vs. Credit Card: Choosing the Right Payment Method

Explore the pros and cons of ACH and credit cards to make informed decisions for your business. Learn why ACH might be superior and how HubSpark can efficiently process these transactions.

Understanding ACH Transactions

ACH transactions involve secure bank-to-bank transfers, offering benefits such as lower transaction fees, robust security, and automated payments. However, drawbacks include longer processing times and limited consumer protections.

Understanding Credit Card Transactions

Credit card transactions provide instant authorization, robust consumer protections, and rewards. However, merchants face higher transaction fees, chargeback risks, and administrative hurdles for account setup.

Pros and Cons of ACH Transactions

Benefits

- 1. Lower transaction fees

- 2. Security and fraud protection

- 3. Automatic and scheduled payments

- 4. Efficient for large transactions

Drawbacks

- 1. Processing time

- 2. Non-immediate confirmation

- 3. Limited consumer protections

- 4. Payment rejection risk

Pros and Cons of Credit Card Transactions

Benefits

- 1. Instant transactions

- 2. Robust consumer protections

- 3. Rewards and benefits

- 4. Convenient and widely accepted

Drawbacks

- 1. Higher transaction fees

- 2. Chargeback risk

- 3. Credit card debt accumulation

- 4. Merchant account setup

Understanding the advantages and disadvantages of ACH and credit card transactions is crucial for choosing the right payment method for your business. HubSpark can serve as a cost-effective tool for efficient payment management.

Comparing ACH and Credit Card Payments

Introduction

Understanding the advantages and differences between ACH (Automated Clearing House) and credit card payments is crucial for businesses seeking reliable and secure financial operations. This comparison explores the key features of each payment method, shedding light on their suitability for various business needs.

Benefits of ACH Transactions

ACH transactions offer distinct advantages, making them preferable for businesses looking for consistency, security, and efficiency in their financial operations.

Predictable Cash Flow

ACH transactions are ideal for managing cash flow, enabling businesses to forecast revenue more accurately. This is particularly beneficial for companies with regular income streams or subscription-based services.

Recurring Payments

ACH transactions are well-suited for facilitating recurring payments and automating billings for utility companies, membership-based organizations, and businesses providing subscription services.

Enhanced Security and Fewer Disputes

ACH transactions generally encounter fewer disputes and offer enhanced security compared to credit cards due to the direct bank-to-bank transfer mechanism, reducing instances of fraudulent activity.

Reduced Risk of Credit Card Fraud

A significant advantage of ACH transactions is the diminished risk of credit card fraud as they rely on bank account details, which are typically more secure and less prone to data breaches.

HubSpark's Payment Processing Solution: HubSpark Payments

Additionally, HubSpark Payments enables businesses to transform their phones into card readers, providing customers with a fast and secure payment option. Beyond payment processing, HubSpark Payments offers a range of solutions to help businesses gather reviews, generate quality leads, and centralize customer data for better marketing and communication.

FAQs: ACH vs. Credit Card

What is the difference between an ACH and a credit card?

ACH transactions involve directly transferring money between bank accounts, while credit card transactions involve borrowing funds from a financial institution.

What is considered an ACH transfer?

An ACH transfer is an electronic transfer of funds from one bank account to another over an electronic network governed by the National Automated Clearing House Association (ACH network).

Is a credit card safer than ACH?

While both credit cards and ACH transactions face security risks, ACH payments are generally considered safer due to their lengthy authorization process and robust fraud detection measures implemented by banks.

Understanding ACH Payment Processing

Learn about the best ACH payment processing software for small businesses and how to choose the right one. ACH payment processing works through software applications, allowing businesses to accept and make payments using the Automated Clearing House (ACH) network.

What is an ACH Payment?

In its simplest form, an ACH payment is a method of transferring funds electronically between banks, eliminating the need for card networks, paper checks, or wire transfers. ACH payments include direct deposit and direct payment options, catering to various business needs.

Choosing an ACH Payment Processing Company

Small business owners must consider several factors when choosing an ACH payment processing company. Features such as flat subscription rates, point-of-sale (POS) system integration, support for global currencies, and security measures should align with the unique requirements of the business.

Benefits of ACH Payment Processing

Excellent Security

ACH payments offer heightened security, reducing the risk of fraud compared to traditional methods like paper checks.

Reduced Errors

ACH processing automates processes, reducing human error and saving time for more valuable tasks.

Affordability

ACH payments cost less than traditional methods, providing significant cost reductions over time.

Recurring Billing Options

ACH processors support recurring billing, making it convenient for businesses with subscription-based models.

Convenience

ACH payments offer convenient one-time or recurring payment options, eliminating the need for checkbooks and ensuring funds reach their destinations efficiently.

ACH Payment Processing FAQs

How do small businesses process ACH payments?

Small businesses typically process ACH payments using a third-party ACH payment processor or ACH payment gateway, allowing direct business ACH payments on websites or apps.

How do small businesses process ACH payments?

Small businesses typically process ACH payments using a third-party ACH payment processor or ACH payment gateway, allowing direct business ACH payments on websites or apps.

What are the best practices for ACH payments?

Best practices include obtaining customer permission before debiting an account, verifying bank account information, and using a secure payment gateway. Additionally, monitoring ACH payments for unexpected errors is crucial.

Do I need both a payment gateway and a payment processor?

Yes, most businesses, especially those accepting online payments, require both a payment gateway and a payment processor to ensure seamless and secure transactions.

Understanding Payment Gateway vs. Payment Processor

Discover the distinctions between a payment gateway and a payment processor, including when to use each and how to choose the right system for your business.

Payment Gateway: What It Is and How It Works?

A payment gateway collects and verifies customers’ card information, ensuring secure transmission to a payment processor for authorization and fund transfer. It is essential for both in-store and online transactions, providing efficiency and integration with accounting software.

Types of Payment Gateways

- Third-Party Payment Gateways: Allow merchants to accept card payments without setting up a merchant account, redirecting customers to a third-party website for transactions.

- Integrated Payment Gateways: Part of the e-commerce platform, enabling customers to stay on the merchant’s website to enter credit card information and complete transactions.

- Payment gateways are vital for scenarios where a physical card isn’t present, such as online payments or phone transactions, providing efficiency and security.

Payment Processor: What It Is and How It Works?

A payment processor executes transactions, ensuring customers have sufficient funds, providing security measures, and facilitating communication between the merchant, issuing bank, and acquiring bank. It enables businesses to accept card-based payments in various scenarios, including in-store, online, over the phone, or via mobile apps.

Importance of Payment Processor

Without a payment processor, businesses would be limited to cash transactions. Payment processors are essential for accepting card payments, ensuring a convenient shopping experience for customers in diverse settings.

Are Payment Gateways and Payment Processors the Same?

No, payment gateways and payment processors are distinct. The payment gateway collects and verifies payment information, while the payment processor executes transactions, ensuring businesses receive their funds.

Which One To Choose?

Many businesses benefit from both payment gateways and payment processors. The choice depends on the business model, transaction volume, budget, required features, and integration capabilities with existing systems.

Navigating Payment Solutions for Business Success

Understanding the nuances of ACH and credit card payments, along with the role of payment gateways and processors, empowers businesses to make informed decisions for seamless, secure, and efficient financial operations. Assessing specific business needs and choosing the right combination of payment solutions ensures a robust foundation for transaction processing.

Optimizing Payment Options for Enhanced Customer Experience

Ensuring a seamless and convenient payment process is crucial for modern businesses. Discover how offering a range of convenient payment methods not only attracts and retains customers but also significantly improves your sales closing rates.

Importance of Convenient Payment Methods

Every business should prioritize convenient payment methods to attract and retain clients. Providing options that align with customer preferences not only results in timely payments but also serves as a competitive advantage, making your business the preferred choice over competitors.

Some consumers abandon a transaction if their preferred payment method is not accepted. This emphasizes the impact of payment methods on customer decisions and overall sales.

The Rise of Contactless Payments

Advancements in technology, especially with platforms like Apple Pay and Google Pay, have led to a surge in the popularity of contactless payments. Utilizing near-field communication (NFC), these methods allow secure transactions without the need for physical cards. The convenience, speed, and security offered by contactless payments have made them increasingly popular, accelerated further by the pandemic.

Consolidating Mobile Payments for Retailers

While the adoption of convenient payments is essential, retailers may face challenges managing multiple systems for various payment methods. Choosing a platform like HubSpark that supports multiple options, including Apple Pay, Google Pay, credit cards, and ACH payments, streamlines the process. This consolidation ensures a smooth experience for both businesses and customers.

The Culture of Convenience

Embracing contactless and other convenient payment methods aligns with the culture of convenience that modern customers appreciate. Simplifying shopping, support interactions, and payments contribute to an efficient and quick customer experience, enhancing the likelihood of closing sales.

The Potential Pitfalls of Disparate Mobile Payments

While diversifying payment methods is essential, managing disparate mobile payments without a unified system can create challenges. Tracking transactions across multiple systems increases complexity, potential errors, and varying fund receipt times. Choosing a comprehensive system minimizes these issues, providing a consolidated experience for faster payments and improved customer satisfaction.

Implementing Convenient Payment Options: A Step-by-Step Guide

Research Customer Preferences

Prioritize customer preferences by conducting research. Understand how your target audience prefers to pay, and consider sending surveys to gather insights. Avoid assumptions and tailor your payment offerings based on actual customer needs to avoid unnecessary costs.

Choose a Comprehensive Payment Solution

Based on customer preferences, select a payment solution that offers multiple methods. Platforms like HubSpark Payments provide diverse options, ensuring compatibility with various payment preferences and consolidating the management of transactions.

Set Up the Chosen Solution

Collaborate with your chosen payment solution provider to set up your account and configure the selected payment methods. Ensure seamless integration with your existing systems and processes for efficient operations.

Advertise Your Payment Options

Inform your customers about the convenient payment methods you now offer. Utilize physical location notices, website updates, and communication channels like text or email to spread awareness. Incorporate these offerings into your sales strategy for maximum impact.

The Power of Convenient Payments: Pros and Cons

Pros

- Meeting customer preferences

- Attracting and retaining customers

- Efficient sales closing

- Faster payment processing

- Reduced time chasing payments

- Enhanced customer experience

- Advertising appeal to prospects

- Streamlined payment acceptance with the right software

Cons

- POS systems limitations for contactless payments (may require upgrades)

- Need to remember processing times and fees for each payment method

Optimizing Your Payment System

If your existing payment system is outdated or lacks certain features, it’s crucial to evaluate and update it. Ensure your business can accept the payment methods your customers desire, providing a seamless and secure transaction experience.

Accepting Contactless Payments and Beyond

Embracing contactless payments, along with a variety of other convenient payment options, significantly contributes to customer satisfaction and increased sales. Whether through EPOS software or innovative solutions like HubSpark Payments, the key is to align with the preferences of the modern, tech-savvy consumer. Stay adaptable and provide a payment experience that reflects the evolving culture of convenience.

Understanding eChecks: A Secure Digital Payment Method

Explore the world of eChecks, a secure digital payment method gaining popularity among small and local businesses. Learn what eChecks are, how they work, and why integrating them into your payment options can enhance the customer journey and expedite payments.

What is an eCheck?

An eCheck, or electronic check, is a digital payment method that enables small businesses to receive payments directly from customers. Functioning as an electronic variation of traditional paper checks, eChecks contain essential information such as bank account numbers, routing numbers, digital signatures, dates, and transaction amounts. This information facilitates secure transactions between the payer’s and payee’s bank accounts.

Distinguishing eChecks from ACH

Although eChecks and ACH transfers are often used interchangeably, there are subtle differences. While both utilize the Automated Clearing House (ACH) network, eChecks represents a newer technology within this framework, handling payment information in a slightly different manner. It’s essential to understand these nuances to determine the fees associated with each transaction type.

Benefits and Advantages of eChecks

- Immediate fund verification

- Enhanced security through encryption and tokenization

- Reversibility, reducing the risk of fraud

- Cost-efficiency with lower processing fees compared to credit cards

- No strict transaction limits, allowing flexibility in purchase sizes

- Applicability for recurring payments, reducing payment disruptions

How eChecks Work?

eChecks can be processed in two main ways: in-person and online. In-person processing involves customers writing a check at the store, which is then scanned to convert it into an eCheck. Online processing requires customers to input relevant banking information into a secure portal. The ACH network handles the transmission, verification, encryption, and processing of funds, ensuring a seamless and automatic transaction process.

eChecks vs. Paper Checks vs. EFT and Wire Transfers

Comparing eChecks to other payment methods emphasizes their advantages. Unlike paper checks, eChecks are more secure, environmentally friendly, and expedite payment processes. Compared to Electronic Funds Transfer (EFT) and wire transfers, eChecks offer cost savings, making them an attractive option for businesses looking to optimize their financial transactions.

Integrating eChecks into Your Payment Options

As a business owner, integrating eChecks into your accepted payment methods can be a game-changer. Update your point-of-sale systems and online platforms to accommodate eCheck transactions. Train your staff to educate customers about the benefits of eChecks, fostering trust and encouraging adoption.

The Future of Digital Payments

eChecks represents a secure, efficient, and cost-effective solution for businesses aiming to stay ahead in the rapidly evolving landscape of digital payments. By integrating eChecks into your accepted payment methods, you not only cater to a broader customer base but also position your business as forward-thinking and customer-centric. Stay informed, adapt to changing trends, and embrace the future of digital payments with eChecks.